Intervalle Technologies: Your Trusted Partner for Integrating Finacle Core Banking Solutions

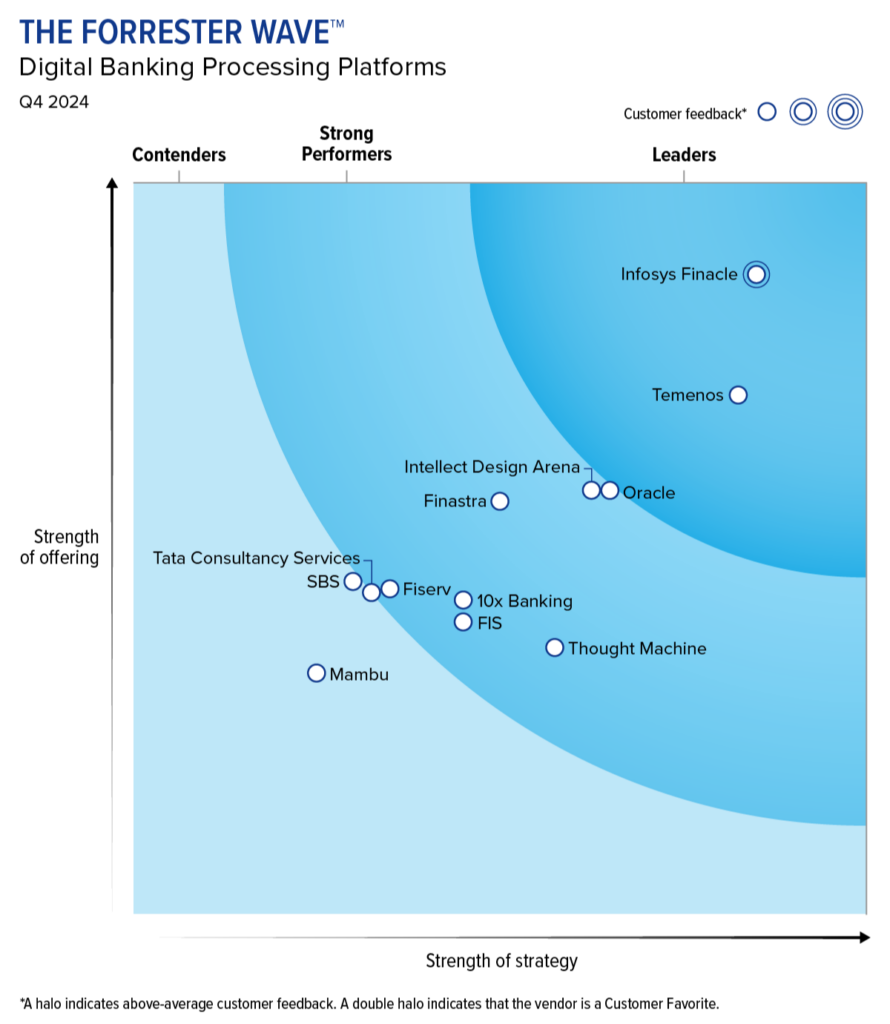

Infosys has chosen Intervalle Technologies as the key partner for deploying its flagship Finacle solution. This core banking suite, a technological gem, will find the best ambassadors in Intervalle for successful integration. A decisive mark of trust in Intervalle's ability to deliver excellence.