The Modern Enterprise Challenge: Managing Risk and Compliance in an AI-Driven World

Enterprise risk and compliance management has become one of the most critical challenges facing organizations today. In addition, the complexity continues to grow exponentially as businesses expand globally, regulations multiply, and digital transformation accelerates across every industry sector.

Understanding the Complexity of Modern Risk Landscapes

The business environment has fundamentally changed. Organizations no longer operate in isolated markets with clear regulatory boundaries. Moreover, they face interconnected risks spanning operational, financial, cyber, third-party, and regulatory domains simultaneously.

The Fragmentation Problem

Most enterprises struggle with scattered risk data across multiple systems. Furthermore, compliance teams work in silos, duplicating efforts and missing critical connections between related risks.

This fragmentation creates blind spots. Organizations cannot see their complete risk exposure. As a result, leadership makes decisions without full visibility into potential consequences.

The Volume Challenge

Regulatory change happens constantly. In fact, compliance teams must monitor thousands of regulatory sources across dozens of jurisdictions. The sheer volume overwhelms traditional manual approaches.

On the other hand, missing a single regulatory update can lead to massive fines. The cost of non-compliance continues rising year over year.

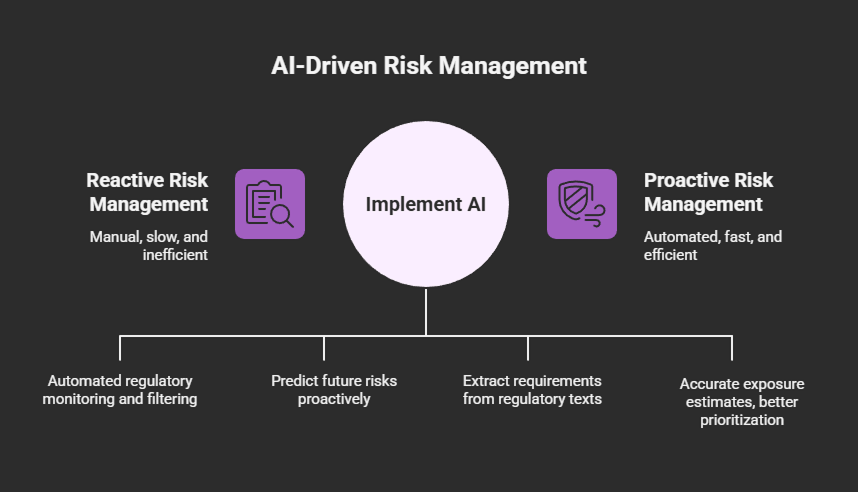

The Shift from Reactive to Proactive Risk Management

Traditional risk management follows a reactive pattern. Teams identify issues after problems emerge. Nevertheless, this approach proves insufficient in today's fast-moving business environment.

Beyond Checkbox Compliance

Many organizations treat compliance as a checkbox exercise. They implement minimum requirements to satisfy auditors. However, this mindset misses the strategic value of integrated risk management.

Effective risk management drives business value. It enables confident decision-making, protects brand reputation, and opens new market opportunities. The bottom line is that risk management should empower growth, not just prevent losses.

The Intelligence Gap

Organizations collect massive amounts of risk data. Despite this, they struggle to extract actionable insights from the information. Risk registers become static documents rather than dynamic intelligence tools.

Leadership needs forward-looking risk intelligence. They need to understand emerging threats before they materialize. For example, early warning signals can prevent major incidents or compliance failures.

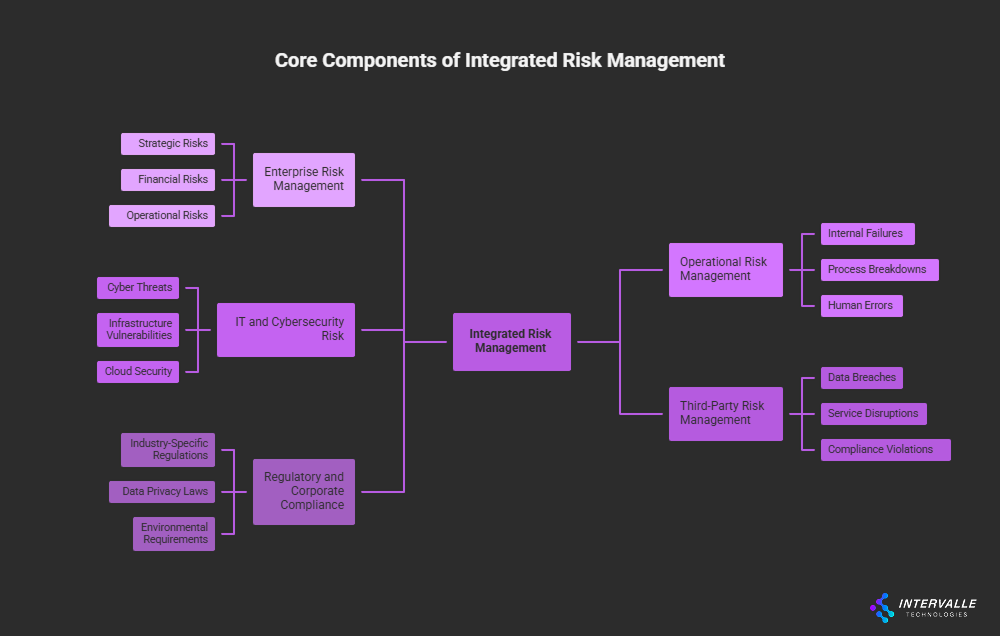

Core Components of Integrated Risk Management

Modern risk management requires a comprehensive approach. Organizations must unify previously disconnected domains into a cohesive strategy.

Enterprise Risk Management

Enterprise risk encompasses strategic, financial, and operational threats. These risks can derail business objectives or damage long-term sustainability. Therefore, organizations need clear visibility into enterprise-level exposure.

Risk quantification proves essential. Qualitative assessments provide limited value for prioritization. Conversely, quantitative approaches enable data-driven resource allocation based on financial impact.

Operational Risk Management

Operational risks arise from day-to-day business processes. They include internal failures, process breakdowns, and human errors. Importantly, operational risks often interconnect with other risk categories.

Process automation reduces operational risk. Standardized workflows ensure consistency. In addition, automated controls catch issues before they escalate into major problems.

IT and Cybersecurity Risk

Technology risks dominate modern risk landscapes. Cyber threats evolve constantly, targeting vulnerabilities across infrastructure, applications, and human factors. Moreover, the shift to cloud computing introduces new security considerations.

Organizations must integrate IT risk with business risk management. Security cannot operate in isolation. As a result, risk frameworks should connect technical vulnerabilities to business impact.

Third-Party Risk Management

Supply chains grow increasingly complex. Organizations rely on numerous vendors, suppliers, and partners. Nevertheless, each relationship introduces potential risks including data breaches, service disruptions, and compliance violations.

Third-party risk assessment requires ongoing monitoring. Initial vendor assessments provide a starting point. However, continuous oversight catches changes in vendor risk profiles over time.

Regulatory and Corporate Compliance

Regulatory compliance spans multiple dimensions. Organizations face industry-specific regulations, data privacy laws, environmental requirements, and corporate governance standards. Furthermore, regulations differ across jurisdictions, creating complexity for global operations.

Compliance management requires centralized visibility. Organizations need a single source of truth for all obligations. For example, a global obligations catalog ensures nothing falls through the cracks.

The Role of Artificial Intelligence in Risk Management

AI transforms how organizations approach risk and compliance. Machine learning algorithms can process vast amounts of data, identify patterns, and generate predictive insights.

Regulatory Intelligence and Horizon Scanning

AI enables automated regulatory monitoring. Instead of manually tracking regulatory sources, AI systems can scan thousands of publications continuously. They filter relevant updates and categorize them by applicable business units.

This automation saves countless hours. Compliance teams receive only pertinent information. As a result, they can focus on strategic response rather than manual research.

Predictive Analytics for Risk Assessment

Historical data contains valuable patterns. AI algorithms can analyze incident data, loss events, and control effectiveness to predict future risks. These predictive models provide early warning signals.

Organizations can shift from reactive to proactive risk management. They identify vulnerabilities before exploitation. In conclusion, predictive analytics enables preventative action rather than damage control.

Natural Language Processing for Obligations Management

Regulatory documents contain complex language. Natural language processing extracts requirements, obligations, and control needs from lengthy regulatory texts. This parsing capability accelerates compliance analysis.

Furthermore, AI can map obligations to existing controls. Gap analysis becomes automated rather than manual. Organizations quickly identify where coverage falls short.

Intelligent Risk Quantification

AI enhances risk quantification methodologies. Machine learning models consider multiple variables simultaneously, producing more accurate exposure estimates. They incorporate historical loss data, industry benchmarks, and control effectiveness ratings.

Quantitative risk assessment enables better prioritization. Organizations allocate resources based on financial impact. To sum up, AI-driven quantification connects risk management to business value.

Building a Unified Risk Management Platform

Fragmentation undermines risk management effectiveness. Organizations need unified platforms that integrate all risk domains.

Centralized Risk Data Repository

A centralized repository serves as the foundation. All risk information flows into a single system. This consolidation eliminates data silos and enables comprehensive analysis.

Data standardization proves critical. Risk information must follow consistent taxonomies and classification schemes. Likewise, standardized metrics enable comparison across business units and risk categories.

Integrated Workflows and Processes

Workflows should span organizational boundaries. Risk assessments trigger control implementations. Control gaps generate audit findings. Audit findings drive corrective actions.

Integration eliminates redundant activities. Different teams access the same underlying data. Moreover, integrated workflows maintain consistency across the risk management lifecycle.

Real-Time Monitoring and Alerting

Static risk assessments quickly become outdated. Organizations need continuous monitoring capabilities. Real-time data feeds update risk profiles as conditions change.

Automated alerting ensures timely response. When risk thresholds are exceeded, relevant stakeholders receive immediate notifications. For example, a vendor security incident triggers alerts to procurement, security, and legal teams simultaneously.

Executive Dashboards and Reporting

Leadership needs clear visibility into risk exposure. Dashboards should present complex information in digestible formats. Visual representations communicate trends, hot spots, and emerging issues effectively.

Reporting must be flexible. Different audiences require different perspectives on risk data. And the best part is that modern platforms enable role-based views customized to stakeholder needs.

Quantifying Risk for Better Decision-Making

Qualitative risk assessments have limitations. Terms like "high," "medium," and "low" lack precision. Conversely, quantitative assessments provide concrete numbers that leadership can use for prioritization.

Moving Beyond Heat Maps

Traditional risk heat maps plot likelihood against impact. However, these assessments remain subjective. Two analysts might rate the same risk differently.

Quantitative approaches use financial metrics. They estimate potential loss exposure in dollar terms. This clarity enables direct comparison with risk mitigation costs.

Loss Data Analysis

Historical loss events provide valuable input. Organizations should systematically collect and analyze incident data. Patterns emerge showing common causes and effective controls.

External loss data supplements internal information. Industry consortiums share anonymized incident data. Therefore, organizations can benchmark their experience against peers.

Control Effectiveness Measurement

Not all controls provide equal value. Organizations should measure control effectiveness objectively. This measurement informs optimization decisions and resource allocation.

Control testing validates effectiveness. Regular assessment ensures controls operate as intended. In addition, testing identifies gaps requiring remediation.

Scenario Analysis and Stress Testing

Scenario analysis explores "what if" questions. Organizations model potential events and their cascading impacts. This forward-looking approach complements historical analysis.

Stress testing examines extreme scenarios. How would the organization respond to a major cyber attack? What would happen if a key vendor failed? These exercises reveal vulnerabilities and test resilience.

The Human Element in Risk Management

Technology enables better risk management. Nevertheless, human expertise remains essential. Risk professionals provide context, judgment, and strategic thinking that algorithms cannot replicate.

Risk Culture and Awareness

Effective risk management requires organizational buy-in. Every employee should understand their role in managing risk. Risk awareness training builds this foundation.

Culture starts at the top. Leadership must demonstrate commitment to risk management. Their actions signal priorities to the entire organization.

Expert-in-the-Loop Methodologies

AI generates insights, but humans make decisions. Expert-in-the-loop approaches combine algorithmic analysis with human judgment. Subject matter experts validate AI outputs and provide necessary context.

This collaboration produces superior results. AI handles data processing at scale. Humans apply expertise and nuanced understanding. Coupled with automation, human insight creates powerful capabilities.

Cross-Functional Collaboration

Risk management cannot succeed in silos. It requires collaboration across functions including compliance, legal, IT, operations, and finance. Breaking down organizational barriers improves risk visibility.

Regular cross-functional meetings facilitate collaboration. Risk committees bring together diverse perspectives. These forums enable holistic risk discussions and coordinated responses.

Continuous Learning and Adaptation

The risk landscape evolves constantly. Risk professionals must stay current with emerging threats, regulatory changes, and industry best practices. Continuous learning proves essential.

Organizations should invest in training and development. Risk teams need access to industry conferences, professional certifications, and peer networks. Moreover, knowledge sharing within the organization multiplies the value of external learning.

Streamlining Compliance Management

Compliance complexity continues growing. Organizations face expanding regulatory obligations across jurisdictions and industries. Streamlining becomes critical for managing this complexity.

Centralized Obligations Library

Organizations need a comprehensive catalog of all obligations. This library should include regulatory requirements, contractual commitments, industry standards, and internal policies. Centralization ensures nothing gets overlooked.

The obligations library serves multiple functions. It provides the foundation for gap analysis. It informs control design. It drives audit planning. Importantly, it creates a single source of truth for compliance requirements.

Automated Gap Analysis

Gap analysis identifies where current controls fall short. Manual gap analysis consumes enormous time and effort. However, automation accelerates this process dramatically.

Automated systems map controls to obligations. They identify gaps where obligations lack corresponding controls. As a result, organizations can prioritize remediation activities based on risk and regulatory importance.

Policy Governance and Lifecycle Management

Policies require ongoing maintenance. Regulations change, business processes evolve, and risks emerge. Policy governance ensures documents remain current and relevant.

Lifecycle management tracks policy versions, reviews, approvals, and attestations. Automated workflows route policies to appropriate stakeholders. On the other hand, manual processes create bottlenecks and delays.

Audit Integration

Internal audit and compliance should work together. Audit findings inform compliance priorities. Compliance gaps drive audit focus areas. Integration eliminates redundancy and strengthens both functions.

Shared systems enable this integration. Audit and compliance teams access the same control frameworks and risk assessments. Therefore, they maintain consistent perspectives on organizational risk and compliance posture.

Resilience Management and Business Continuity

Resilience extends beyond risk prevention. Organizations must also prepare for recovery when incidents occur. Business continuity planning proves essential.

Business Impact Analysis

Business impact analysis identifies critical processes and dependencies. Organizations assess potential disruption impacts on operations, revenue, and reputation. This analysis informs recovery priorities.

Dependencies reveal vulnerabilities. Critical processes often rely on specific systems, facilities, or personnel. Consequently, organizations must plan for potential disruptions to these dependencies.

Incident Response Planning

Incident response plans provide structured approaches for managing crises. Plans should cover various scenarios including cyber attacks, natural disasters, supply chain disruptions, and pandemic events.

Regular testing validates response plans. Tabletop exercises walk through scenarios without actual disruption. Full-scale tests activate response procedures. In addition, testing identifies gaps requiring plan updates.

Recovery Time Objectives

Recovery time objectives define acceptable downtime for critical processes. These targets guide investment in backup systems and redundancy. They also inform vendor SLA negotiations.

Balancing cost and resilience requires careful analysis. Maximum resilience proves prohibitively expensive. Organizations must identify appropriate recovery targets based on business impact and risk tolerance.

Crisis Communication

Communication during crises can make or break response effectiveness. Organizations need predefined communication plans covering internal stakeholders, customers, regulators, and media. Clear messaging reduces confusion and maintains trust.

Communication templates speed response. Predefined message frameworks require only situation-specific details. Despite this, organizations must adapt templates to each unique situation.

Measuring Risk Management Program Effectiveness

Organizations must assess whether their risk management programs deliver value. Measurement enables continuous improvement and demonstrates ROI to stakeholders.

Key Risk Indicators

Key risk indicators provide early warning signals. These metrics track factors that could indicate increasing risk exposure. Trending over time reveals whether risk profiles are improving or deteriorating.

Effective KRIs are measurable, actionable, and linked to material risks. They should trigger investigation or response when thresholds are exceeded. For example, increasing vendor security incidents might indicate third-party risk program weaknesses.

Program Maturity Assessment

Maturity models provide frameworks for assessing program sophistication. Organizations can benchmark their capabilities against industry standards. Maturity assessments identify improvement opportunities.

Maturity typically evolves through stages. Initial programs focus on basic compliance. Mature programs integrate risk into strategic decision-making. Organizations should set realistic targets based on their current state and resources.

Cost of Risk Measurement

Total cost of risk includes multiple components. Direct losses from incidents represent one element. However, organizations should also consider risk management program costs, insurance premiums, and opportunity costs from risk-averse decisions.

Tracking total cost of risk enables ROI analysis. Effective risk management should reduce overall costs while enabling business growth. The bottom line is that risk management creates value through both loss prevention and opportunity enablement.

Stakeholder Satisfaction

Risk management serves various stakeholders. Leadership needs strategic risk insights. Business units need practical risk support. Auditors need control evidence. Satisfaction surveys gauge whether the program meets stakeholder needs.

Feedback drives improvement. Stakeholders provide valuable perspectives on program strengths and weaknesses. Moreover, their input ensures the program remains aligned with organizational priorities.

Future Trends in Risk and Compliance Management

Risk management continues evolving. Several trends will shape the future of how organizations approach governance, risk, and compliance.

Convergence of Risk Domains

Artificial barriers between risk categories are dissolving. Cyber risk affects operational continuity. Third-party relationships create compliance obligations. ESG factors introduce financial and reputational risks.

Integrated approaches recognize these connections. Organizations need platforms that support cross-domain analysis. Here's how convergence changes risk management: holistic visibility replaces fragmented views.

Real-Time Risk Management

Annual risk assessments prove insufficient. Organizations need continuous risk monitoring. Real-time data feeds enable dynamic risk management that adapts to changing conditions.

Internet of Things sensors provide operational risk data. Security information and event management systems track cyber threats. Regulatory change services monitor compliance obligations. Therefore, risk profiles update constantly rather than periodically.

Predictive Risk Intelligence

Backward-looking risk assessments give way to forward-looking intelligence. Predictive models anticipate emerging risks before they materialize. This shift enables proactive risk management.

Machine learning algorithms improve prediction accuracy over time. They incorporate new data and refine models continuously. And the best part is that prediction quality increases as more data becomes available.

ESG Integration

Environmental, social, and governance factors are now recognized as material risks. Investors demand ESG transparency. Regulators impose ESG reporting requirements. Organizations must integrate ESG into comprehensive risk frameworks.

ESG risks interconnect with traditional categories. Climate change creates operational risks. Social factors affect workforce stability. Governance failures lead to compliance violations. Consequently, ESG cannot be managed in isolation.

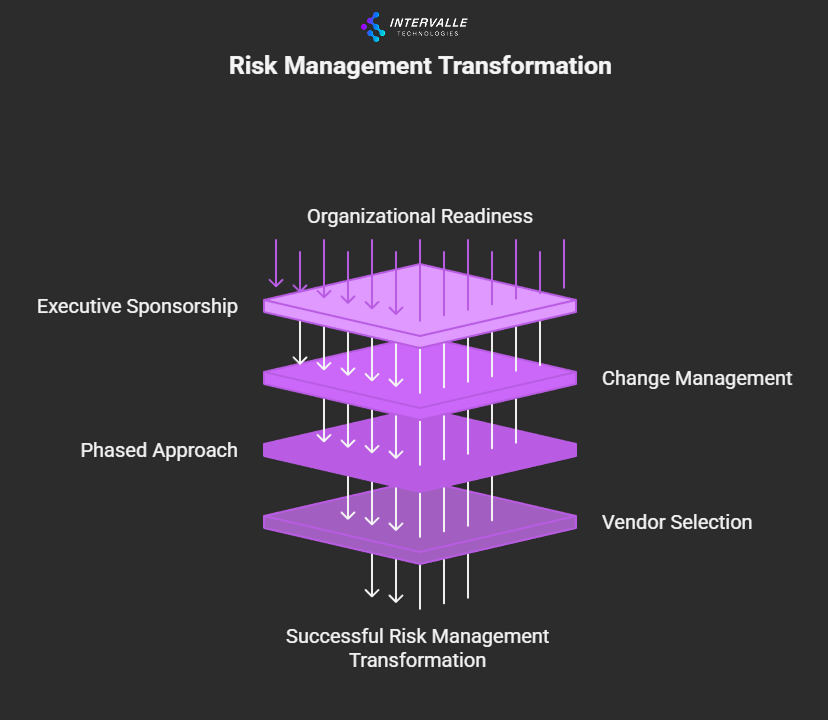

Implementation Considerations for Enterprise Programs

Organizations embarking on risk management transformation face numerous decisions. Successful implementation requires careful planning and realistic expectations.

Executive Sponsorship

Risk management transformation requires executive support. Leadership must champion the initiative, allocate resources, and drive organizational change. Without executive sponsorship, programs struggle to gain traction.

Board engagement strengthens programs. Regular risk reporting to the board elevates risk management importance. It also ensures alignment between risk management and corporate strategy.

Change Management

Risk management affects the entire organization. Implementation requires changing processes, behaviors, and cultures. Effective change management ensures smooth transitions.

Communication proves essential. Stakeholders need to understand why changes are occurring and how they benefit. Training prepares people for new tools and processes. In addition, quick wins build momentum and demonstrate value.

Phased Approach

Attempting to transform everything simultaneously often fails. Phased implementations prove more successful. Organizations should start with high-priority domains and expand gradually.

Each phase delivers tangible value. Early successes build credibility and support for subsequent phases. Moreover, phased approaches enable learning and adjustment before major commitments.

Vendor Selection Criteria

Organizations often engage technology vendors for risk management platforms. Vendor selection significantly impacts program success. Critical criteria include functionality, integration capabilities, scalability, and vendor stability.

Reference checks provide valuable insights. Existing customers can share implementation experiences and ongoing satisfaction. Furthermore, proof of concept projects validate whether solutions meet specific organizational needs.

Conclusion: The Strategic Value of Integrated Risk Management

Modern enterprises cannot afford fragmented approaches to risk and compliance. The interconnected nature of today's threats demands unified strategies and integrated platforms.

Organizations that embrace comprehensive risk management gain competitive advantages. They make faster decisions with greater confidence. They avoid costly compliance failures. They optimize resource allocation based on quantitative risk assessment.

Technology enables transformation, but success requires more than tools. It demands executive commitment, organizational change, and cultural evolution. Risk management must shift from compliance burden to strategic enabler.

The journey toward integrated risk management takes time. However, the destination proves worth the effort. Organizations with mature risk management capabilities are better positioned for sustainable growth in an increasingly complex and uncertain world.

To sum up, integrated risk and compliance management represents not just operational necessity but strategic imperative. Organizations that recognize this reality and act accordingly will outperform peers who treat risk as an afterthought.